What Increases Your Total Loan Balance? When you borrow money — whether for education, a car, a home, or business — you expect to repay what you owe over time. However, many borrowers notice that their total loan balance sometimes increases instead of decreasing, even after making regular payments.

This can be frustrating and confusing. How can your balance go up when you’re trying to pay it down? The answer lies in understanding how loans work, how interest is calculated, and what actions (or inactions) affect the total amount you owe.

This detailed guide explains what increases your total loan balance, breaks down the financial mechanisms behind it, and provides practical steps to help you keep your debt under control.

What Is a Loan Balance?

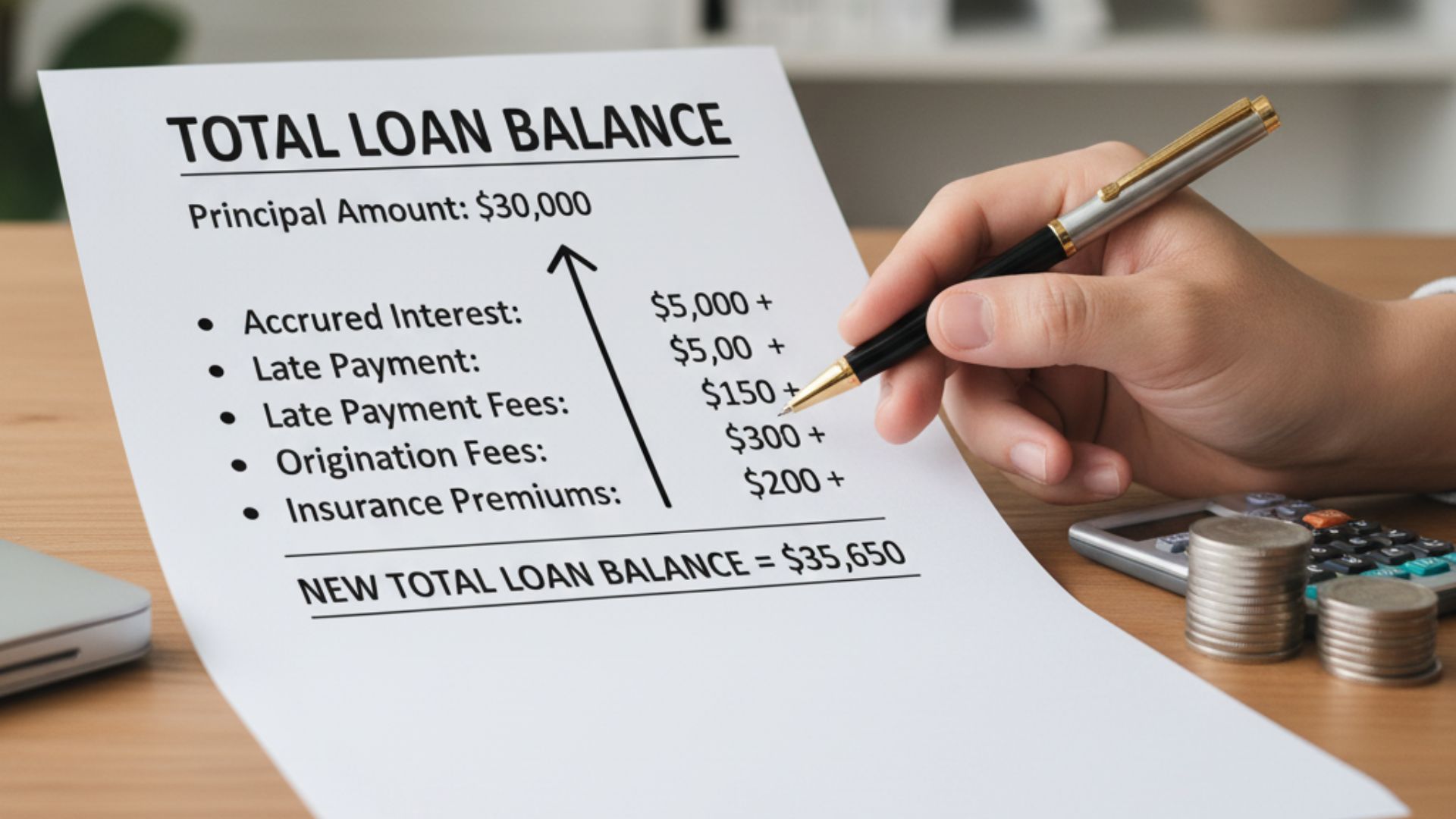

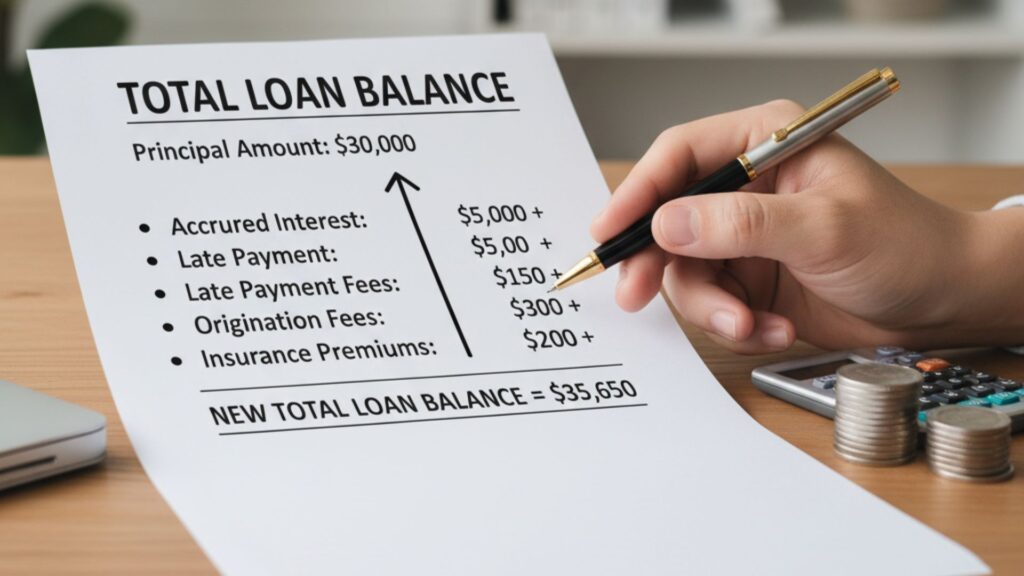

Your loan balance refers to the total amount you owe to a lender at any given point in time. It includes:

- The principal amount (the original sum borrowed)

- Any accrued interest (interest that has accumulated but not yet been paid)

- Any fees or penalties added by the lender

Your total loan balance is dynamic — it changes over time as interest accrues, payments are made, or new charges are added.

For example, if you borrow $10,000 with a 6% annual interest rate, and you make monthly payments, your balance will gradually decrease. But if you miss payments or if interest is capitalized, your total loan balance can rise above the original borrowed amount.

Key Factors That Increase Your Total Loan Balance

Let’s explore the most common reasons why your total loan balance increases over time.

a. Accrued Interest

Interest is the cost of borrowing money. It accumulates daily or monthly depending on your loan agreement.

If you have a loan where interest continues to accrue while you’re not making payments — such as during a deferment or forbearance period — the unpaid interest adds up.

Eventually, this accrued interest can be capitalized, meaning it is added to your principal balance. Once that happens, future interest is charged on the new, higher principal, making your total balance grow faster.

Example:

- Original loan: $20,000 at 5% interest.

- Interest accrues for one year during deferment: $1,000.

- If unpaid, that $1,000 is added to your balance, making the new principal $21,000.

- You now pay interest on $21,000 instead of $20,000.

b. Capitalized Interest

As mentioned, capitalization occurs when unpaid interest is added to the principal. It’s one of the biggest contributors to loan balance growth, especially in student loans and mortgage loans.

Capitalization can occur in the following situations:

- After a deferment or forbearance period ends

- When you miss payments or fail to make interest-only payments

- When you switch repayment plans

- When your loan enters repayment after graduation

Once capitalization happens, the total balance grows because you start paying interest on top of interest.

c. Late Fees and Penalties

Missing payments or paying late often leads to late fees, which are added directly to your loan balance.

For instance, if your payment is due on the 10th and you pay on the 15th, your lender might charge a $25 or $50 late fee. Over time, consistent delays can significantly increase your total debt.

Moreover, if you default on your loan, you could also face collection fees, legal costs, and additional interest, all of which inflate your balance.

d. Negative Amortization

Negative amortization occurs when your monthly payment is less than the interest due.

In this case, the unpaid interest is added to your principal balance, making your debt grow instead of shrink.

This often happens with income-driven repayment plans for student loans or adjustable-rate mortgages, where the minimum payment doesn’t fully cover the accrued interest.

Example:

- Interest due monthly: $200

- Payment made: $150

- Unpaid $50 is added to the loan balance, increasing your total debt.

e. Loan Forbearance or Deferment

While deferment or forbearance can offer temporary relief from payments, they often cause your total balance to grow.

During these periods, interest may continue to accrue, and if unpaid, it can later be capitalized.

Borrowers sometimes assume that “pausing” payments also pauses interest — but in most loan types, it does not.

f. Variable Interest Rates

Loans with variable interest rates can experience fluctuating interest costs over time.

If the interest rate rises, more interest accrues each month, increasing the total amount you owe. This is common in private student loans and some types of mortgages or credit lines.

g. Collection Costs (in Case of Default)

If your loan enters default (typically after 270 days of nonpayment for federal student loans), the lender can charge collection fees of up to 25% of the balance.

For example, a $10,000 defaulted loan could immediately become $12,500 or more once fees are added. These costs significantly increase your total loan balance.

h. Loan Consolidation or Refinancing Mistakes

While consolidation or refinancing can simplify repayment or reduce interest rates, they can also increase your balance if not managed carefully.

Some consolidation loans include origination fees, while others capitalize unpaid interest from the previous loans, increasing your new principal.

The Role of Interest Rates and Compounding

Interest rate type and compounding frequency play a critical role in how your total balance grows.

Types of Interest Rates:

- Fixed Rate: Stays the same throughout the loan term. Predictable but can still accumulate.

- Variable Rate: Changes based on market conditions. Can increase unexpectedly, causing your balance to grow faster.

Compounding Frequency:

Interest may compound daily, monthly, or annually. The more frequently it compounds, the faster your loan balance can increase.

For instance, daily compounding interest adds slightly more cost over time than annual compounding because interest is continuously added to the principal.

How Missed or Partial Payments Affect Loan Balance?

Failing to make full payments each month leads to delinquency, where interest and fees continue to pile up.

Even if you make partial payments, unpaid portions of the bill accrue interest. Over months or years, this can result in a significantly higher total loan balance.

Missing payments can also harm your credit score, which may lead to higher borrowing costs in the future.

Loan Types Most Affected by Balance Growth

Different types of loans are affected by balance growth in different ways.

| Loan Type | Common Causes of Balance Increase | How to Prevent It |

|---|---|---|

| Student Loans | Capitalized interest, deferment, income-driven plans | Pay interest during school or deferment periods |

| Mortgage Loans | Adjustable rates, negative amortization | Choose fixed-rate loans, avoid interest-only options |

| Auto Loans | Missed payments, late fees | Set up auto-pay, pay on time |

| Personal Loans | Late fees, high interest | Avoid default, make extra payments |

| Credit Cards | Compounding interest, penalties | Pay full balance monthly, reduce credit usage |

Strategies to Prevent Loan Balance Growth

Now that we understand what increases your total loan balance, here are effective ways to control and reduce it.

a. Pay Interest Early and Regularly

Even if payments aren’t required yet (for example, during deferment), paying off interest prevents it from capitalizing later.

b. Avoid Forbearance Unless Absolutely Necessary

Forbearance offers temporary relief but leads to interest accumulation. Consider income-driven repayment or refinancing instead.

c. Make Extra Payments Toward Principal

Extra payments help reduce the principal faster, lowering future interest charges. Always confirm with your lender that extra payments go toward principal, not future interest.

d. Refinance to a Lower Interest Rate

If eligible, refinancing can reduce your interest rate, minimizing the total interest that accrues.

e. Stay Consistent with Payments

Automatic payments help ensure you never miss a due date, avoiding penalties and negative credit marks.

f. Understand Your Loan Terms

Read your loan agreement carefully to know when and how interest accrues, when capitalization occurs, and what triggers penalties.

g. Monitor Your Loan Regularly

Check your loan statements monthly to verify that payments are applied correctly and interest isn’t accumulating unexpectedly.

Real-Life Example: Student Loan Scenario

Consider a borrower with a $30,000 student loan at 6% interest who takes a 12-month deferment.

- Monthly interest: $150

- Interest accrued in one year: $1,800

- New balance after capitalization: $31,800

Now, instead of paying interest on $30,000, the borrower pays interest on $31,800. Over a 10-year repayment term, this adds hundreds or even thousands of dollars in additional costs.

The Psychological Impact of a Growing Loan Balance

Beyond the financial burden, seeing a growing loan balance can cause stress and discouragement. Borrowers often feel trapped, even when making payments diligently.

The key is to stay informed and proactive. By understanding the mechanics of your loan, you regain control over your financial future.

Financial literacy, budgeting, and consistent payment behavior are the best defenses against runaway debt.

Key Takeaways

- Your total loan balance increases primarily due to accrued and capitalized interest.

- Missed or partial payments lead to penalties and compounding interest growth.

- Variable rates and negative amortization can cause unexpected balance increases.

- Understanding loan terms and making regular interest payments can prevent future debt escalation.

- Proactive repayment strategies — such as refinancing, auto-pay, and extra principal payments — are essential to reducing total debt over time.

Important Links and Information about Loan Balance Management

| Category | Information / Link |

|---|---|

| Definition | Total amount owed, including principal, interest, and fees |

| Primary Cause of Increase | Accrued and capitalized interest |

| Federal Student Aid | https://studentaid.gov |

| Credit Report Access | https://www.annualcreditreport.com |

| Loan Calculator | https://www.bankrate.com/calculators/ |

| Refinancing Options | Check with major banks or credit unions |

| Consumer Financial Protection Bureau (CFPB) | https://www.consumerfinance.gov |

| Financial Counseling | https://www.nfcc.org |

FAQ about What Increases Your Total Loan Balance?

Why does my loan balance keep increasing even though I’m making payments?

If your payments don’t cover the accrued interest or fees, the unpaid portion may be added to your balance through capitalization, causing it to grow.

How does deferment or forbearance increase my loan balance?

During these periods, interest often continues to accrue. When repayment resumes, that interest may be capitalized, raising your total balance.

Can making extra payments reduce my loan balance faster?

Yes. Making extra payments toward your principal directly reduces your balance and lowers the amount of future interest.

What’s the difference between accrued interest and capitalized interest?

Accrued interest is unpaid interest that builds up over time. Capitalized interest occurs when that unpaid interest is added to your loan principal.

Does refinancing help lower my total loan balance?

Refinancing can reduce your interest rate, which slows the accumulation of interest. However, be cautious of fees or extended terms that could increase long-term costs.

Can late payments increase my loan balance?

Yes, late payments result in penalties, fees, and continued interest accrual, all of which raise your total debt.

What should I do if I can’t afford my payments?

Contact your lender immediately. You may qualify for income-driven repayment, refinancing, or temporary relief without letting interest balloon unchecked.

Conclusion

Understanding what increases your total loan balance is essential for every borrower. While factors like interest, capitalization, and fees can quietly inflate your debt, they are not beyond your control.

With informed planning, disciplined payment habits, and proactive financial management, you can prevent unnecessary balance growth and pay off your loans efficiently.

Your loan should serve as a stepping stone toward your goals — not a lifelong burden. By staying informed and vigilant, you can take control of your financial journey and ensure that your debt decreases over time, not the other way around.